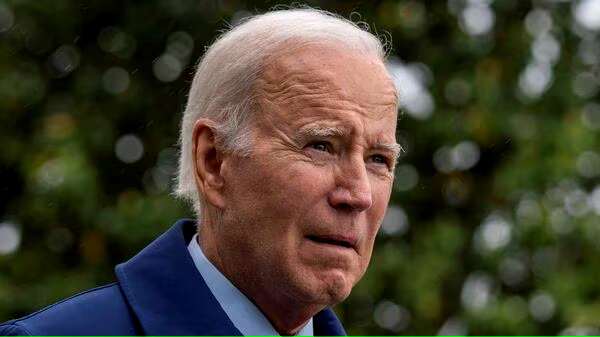

Student Loan Borrowers Not Guaranteed Relief Under Biden's New Plan

President Biden's new plan to provide student loan relief for borrowers who need it most has been met with mixed reactions from advocates and experts. The plan, which was announced after the Supreme Court struck down his previous proposal to cancel up to $20,000 in federal student loans for 43 million people, aims to use the authority of the Higher Education Act of 1965 to compromise, waive or release student loans. However, the details of who will qualify and how much of their debt will be forgiven are still unclear and will depend on a lengthy rulemaking process.

What is the new plan?

Biden's new plan is based on three main components:

- A 12-month grace period for borrowers who struggle to resume payments after the pandemic pause ends in September. During this period, borrowers can skip payments without penalty or damage to their credit scores, but interest will resume accruing on their loans.

- A new income-driven repayment plan that will lower monthly payments for millions of borrowers and speed up forgiveness for many others. The plan will cap payments at 10% of discretionary income for borrowers with undergraduate loans and 15% for those with graduate loans. It will also forgive the remaining balance after 20 years for undergraduate loans and 25 years for graduate loans, down from 25 and 30 years respectively under the current plans.

- A targeted debt relief program that will use the education secretary's authority under the Higher Education Act to cancel or reduce student loans for borrowers who face undue hardship, such as those who are disabled, defrauded by their schools, or work in public service.

Who will benefit from the new plan?

The Education Department estimates that the new plan will benefit about 41 million borrowers, or 90% of those with federal student loans. According to the department, the new income-driven repayment plan will:

- Cut monthly payments by an average of $140 for 18 million borrowers

- Reduce interest charges by an average of $25,000 over the life of the loan for 6 million borrowers

- Provide immediate forgiveness for 2 million borrowers who have been in repayment for more than 20 years

- Simplify enrollment and recertification processes for borrowers

The targeted debt relief program is expected to help millions more borrowers who face exceptional circumstances, such as:

- Borrowers with total and permanent disabilities who are eligible for discharge but have not applied or completed the process

- Borrowers who attended schools that closed or engaged in misconduct and are eligible for borrower defense to repayment

- Borrowers who work in public service and are eligible for Public Service Loan Forgiveness but have not received it due to errors or confusion

What are the challenges and limitations of the new plan?

While many advocates and experts have welcomed Biden's new plan as a step in the right direction, they have also raised some concerns and questions about its implementation and impact. Some of the challenges and limitations of the new plan include:

- The rulemaking process: The Education Department will have to go through a lengthy and complex process of negotiated rulemaking to finalize the details of the new plan. This involves consulting with various stakeholders, such as student groups, consumer advocates, lenders, servicers, and state officials, and reaching a consensus on the regulations. The process could take months or even years to complete, and could face legal challenges or political opposition along the way.

- The eligibility criteria: The new plan does not specify how the education secretary will determine who qualifies for targeted debt relief under the Higher Education Act. The department will have to establish clear and consistent criteria and procedures for evaluating borrowers' claims and applications. The department will also have to ensure that borrowers are aware of their options and rights, and that they receive accurate and timely information from their servicers.

- The scope of relief: The new plan does not guarantee relief for all borrowers who need it most. For example, it does not address the plight of borrowers who have private student loans, which are not covered by federal programs or protections. It also does not provide relief for borrowers who have already defaulted on their loans, which can have serious consequences such as wage garnishment, tax refund seizure, or loss of benefits. Moreover, it does not cancel a significant amount of debt for most borrowers, which could limit their ability to build wealth, invest in their future, or contribute to the economy.

Conclusion

Biden's new plan to provide student loan relief for borrowers who need it most is a welcome initiative that could ease the burden on millions of Americans who are struggling with their debt. However, the plan is not a silver bullet that will solve the student debt crisis or address its root causes. The plan faces many uncertainties and challenges in its implementation and impact, and it leaves out many borrowers who deserve relief. Therefore, advocates and experts urge Biden and Congress to pursue more comprehensive and ambitious reforms that will make college more affordable, accessible, and equitable for all.

Source:

FAQ's

How do I know if my student loans will be forgiven?

Who qualifies for student loan forgiveness? To be eligible for forgiveness, you must have federal student loans and earn less than $125,000 annually (or $250,000 per household). Borrowers who meet that criteria can get up to $10,000 in debt cancellation.

Will Biden forgive private student loan debt?

Additionally, private loans won't qualify for any future federal forgiveness programs, including the Biden administration's contested plan to cancel $10,000 in student loans for borrowers making less than $125,000 per year, and as much as $20,000 for Pell Grant recipients.

What happens if you default on a student loan?

Consequences of Default

The entire unpaid balance of your loan and any interest you owe becomes immediately due (this is called "acceleration"). You can no longer receive deferment or forbearance, and you lose eligibility for other benefits, such as the ability to choose a repayment plan.

How can I pay off my student loans?

How to Pay Off Student Loans Fast

1. Make extra payments toward the principal.

Refinance if you have good credit and a steady job.

Enroll in autopay.

4. Make biweekly payments.

Pay off capitalized interest.

Stick to the standard repayment plan.

Use 'found' money.

0 Comments